Sparkdex

Sparkdex: How Sparkdex Combines AI and DeFi to Redefine Decentralized Trading

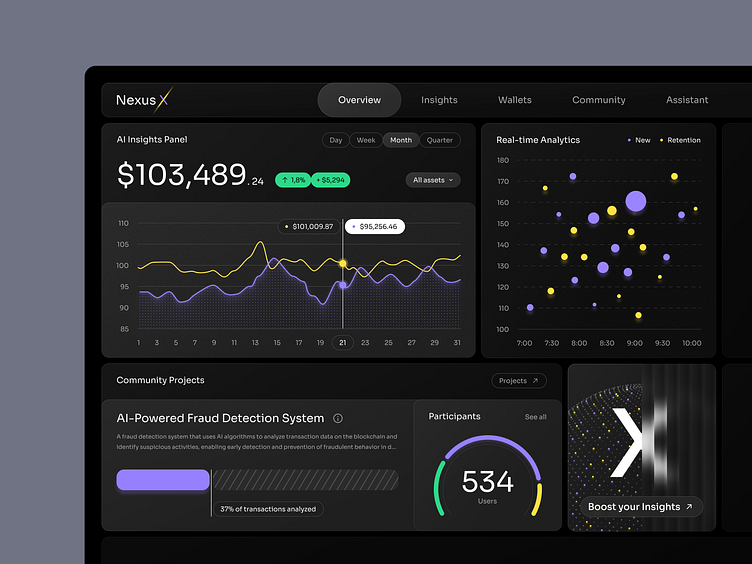

Decentralized finance has transformed how users trade and manage digital assets, but it still faces challenges related to efficiency, usability, and decision-making. As markets become more competitive and data-driven, simply offering decentralized access is no longer enough. Sparkdex represents a new generation of platforms that combine artificial intelligence with DeFi principles to redefine how decentralized trading works. Many users first explore Sparkdex to understand how AI-driven intelligence can enhance on-chain trading while preserving decentralization and user control.

This article explains how Sparkdex brings together AI and DeFi, what problems this combination solves, and why it represents an important shift in decentralized trading. The content is optimized for SEO and follows EEAT principles by focusing on transparency, real-world relevance, and credible industry context.

The Evolution of Decentralized Trading

Decentralized exchanges were created to remove intermediaries, reduce counterparty risk, and give users full control over their assets. While these goals have largely been achieved, early DeFi platforms often relied on static logic and manual decision-making.

Key limitations of traditional DeFi trading include:

Manual strategy execution

Limited optimization of trade routes and liquidity

High cognitive load on users

Inefficiencies during volatile market conditions

These limitations create an opportunity for AI-driven systems like Sparkdex to add intelligence without reintroducing centralization.

Sparkdex Vision: AI Meets DeFi

Sparkdex is built on the idea that artificial intelligence can enhance decentralized trading without compromising transparency or user sovereignty.

Its vision is based on:

AI-assisted analysis and optimization

Decentralized, non-custodial infrastructure

Automated yet controllable execution

Data-driven trading intelligence

By combining these elements, Sparkdex aims to redefine how users interact with decentralized markets.

Sparkdex AI Layer Explained

Intelligent Market Analysis

AI plays a key role in how Sparkdex interprets market data.

AI-driven capabilities may include:

Identifying market patterns

Analyzing liquidity conditions

Supporting smarter trade execution decisions

Rather than replacing traders, AI acts as a decision-support layer that enhances situational awareness.

Adaptive Execution Strategies

Markets change rapidly, and static strategies can become inefficient.

Sparkdex uses AI to support:

Dynamic adjustment to market conditions

Smarter timing of execution

Optimization of trade paths

This adaptability improves performance while remaining rule-based and transparent.

Sparkdex DeFi Foundations Remain Intact

Despite its AI capabilities, Sparkdex remains fundamentally decentralized.

Non-Custodial Asset Control

Sparkdex does not take custody of user funds.

This ensures:

Users retain full control over assets

Reduced counterparty and custodial risk

Alignment with core DeFi principles

AI enhances decisions, but control stays with the user.

On-Chain Transparency

Execution logic in Sparkdex is designed to be transparent and verifiable.

Transparency provides:

Trustless verification of outcomes

Clear understanding of automated behavior

Confidence in system integrity

These qualities distinguish Sparkdex from opaque, centralized trading systems.

Sparkdex Automation in Decentralized Trading

Automation is the bridge between AI insights and DeFi execution.

Event-Driven Trading Logic

Sparkdex supports event-driven automation rather than constant manual input.

This enables:

Automated responses to price movements

Strategy execution based on predefined conditions

Faster reaction times in volatile markets

Automation reduces the need for constant monitoring.

Controlled and Deterministic Rules

Automation in Sparkdex is bounded by deterministic rules.

Key benefits include:

Predictable execution

Easier auditing and debugging

Reduced risk of unintended actions

This ensures AI-driven automation remains safe and explainable.

Benefits of Combining AI and DeFi With Sparkdex

The integration of AI and DeFi delivers tangible advantages to different participants.

Benefits for Traders

Traders may experience:

Improved execution efficiency

Reduced manual workload

Better-informed decision-making

AI assists without removing autonomy.

Benefits for Liquidity Providers

Liquidity providers can benefit from:

Smarter liquidity utilization

Data-driven optimization insights

Improved capital efficiency

AI helps adapt strategies to real market conditions.

Sparkdex and Market Efficiency

Market efficiency is a key challenge in decentralized trading.

Sparkdex contributes to improved efficiency by:

Reducing slippage through smarter routing

Responding dynamically to liquidity changes

Minimizing latency between insight and execution

These improvements help decentralized markets compete with centralized alternatives.

Industry Context: AI and DeFi Convergence

The convergence of AI and decentralized finance is part of a broader industry trend. Insights from Forbes at https://www.forbes.com often highlight how artificial intelligence is reshaping financial services by improving automation, analytics, and efficiency. At the same time, foundational principles of decentralized execution and trustless systems discussed by Ethereum at https://ethereum.org explain why transparency and user control remain essential as innovation accelerates.

Sparkdex sits at the intersection of these two movements.

Challenges in AI-Powered Decentralized Trading

While the AI-DeFi combination is powerful, it also introduces challenges.

Key considerations include:

Complexity of AI-driven logic

User understanding of automated behavior

Governance and transparency of AI decisions

Managing edge cases in volatile markets

Sparkdex addresses these challenges through deterministic rules and clear execution boundaries.

Sparkdex Security and Trust Model

Security is critical in any decentralized trading platform.

Sparkdex emphasizes:

Transparent execution logic

User-controlled automation settings

Clear limits on AI-driven actions

These safeguards help maintain trust while enabling innovation.

Sparkdex Use Cases in Practice

Practical applications of AI-driven DeFi on Sparkdex include:

Automated trading strategies

AI-assisted market monitoring

Adaptive liquidity management

Event-triggered execution workflows

These use cases demonstrate how AI can enhance decentralized trading without centralization.

Preparing for the Future of Decentralized Trading

As DeFi continues to evolve, platforms that combine intelligence with decentralization are likely to gain traction.

Sparkdex positions itself for this future by:

Embracing AI responsibly

Preserving DeFi core principles

Focusing on scalability and transparency

This balance is critical for long-term adoption.

Revisiting Sparkdex as AI and DeFi Mature

Both AI and DeFi are rapidly evolving fields. As capabilities expand and user expectations change, revisiting Sparkdex allows traders and builders to stay aligned with new features, improved models, and refined execution patterns.

Final Thoughts: Sparkdex Redefining Decentralized Trading

Sparkdex demonstrates how artificial intelligence and decentralized finance can work together rather than in opposition. By combining AI-driven insights with transparent, non-custodial execution, Sparkdex redefines decentralized trading as smarter, more adaptive, and more efficient.

For users seeking the next evolution of DeFi—one that blends intelligence with trustless infrastructure—Sparkdex offers a compelling vision of how decentralized trading can evolve in the years ahead.

Comments

Post a Comment